Building Wealth with Fixed Income- Types, Risks, and Benefits

Many individuals plan to build long-term wealth, aiming for financial stability and security. While discussions on investment strategies often focus on equities and other high-risk assets, the significance of fixed income investments in maintaining a balanced portfolio should not be underestimated. These investments offer a steady stream of income, capital preservation, and predictability, which can complement higher-risk assets and contribute significantly to long-term wealth creation.

In India, fixed income investments hold a substantial share, accounting for approximately 70% of all investment assets. This statistic highlights their widespread popularity and crucial role in financial planning, highlighting the multitude of benefits they offer.

With their predictable returns and lower volatility compared to other asset classes, fixed income instruments offer investors stability and income generation.

Fixed income, also known as debt or bond investing, involves purchasing securities that pay a fixed interest or dividend income until maturity. These securities represent loans made by investors to entities such as governments, municipalities, or corporations, which promise to repay the borrowed principal amount along with periodic interest payments.

Fixed income securities come in various forms, each with its unique characteristics and risk-return profiles. The primary types include:

Types of Fixed Income Products

- Government Bonds- Issued by sovereign governments, these bonds are considered the safest fixed income investments due to the backing of the issuing government’s full faith and credit.

- Corporate Bonds- Issued by corporations to raise capital, these bonds offer higher yields than government bonds but also carry higher default risk.

- Municipal Bonds- Issued by state and local governments to finance public projects, municipal bonds provide tax advantages for investors and are relatively safe, depending on the issuer’s creditworthiness.

- Treasury Securities- These include Treasury bills (T-bills), Treasury notes, and Treasury bonds issued by the U.S. Department of the Treasury, considered the safest fixed income investments in the world.

- Certificates of Deposit (CDs)– Offered by banks, CDs are time deposits with fixed interest rates and maturity dates, providing guaranteed returns but with limited liquidity.

Investing in Fixed Income

Investors can access fixed income securities through various channels, including brokerage accounts, mutual funds, and direct purchases from issuers or government agencies.

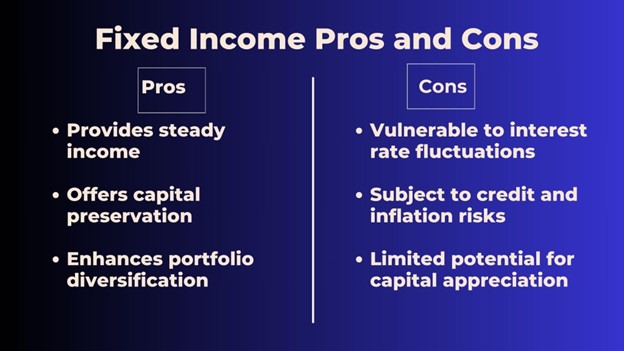

Advantages

- Steady Income- Fixed income securities provide regular interest payments, offering investors a predictable income stream.

- Capital Preservation- Government and high-quality corporate bonds offer relatively low risk of default, making them suitable for preserving capital.

- Diversification- Fixed income investments can diversify a portfolio by providing stability and counterbalancing the volatility of equities.

Risks Associated

- Interest Rate Risk- Fixed income securities are sensitive to changes in interest rates, with bond prices inversely related to interest rate movements.

- Credit Risk- The risk of issuer default or inability to meet debt obligations can result in loss of principal and missed interest payments.

- Inflation Risk- Fixed income returns may erode in real terms if inflation outpaces the interest earned on investments.

Fixed Income Pros and Cons

What to Consider before Investing in this?

When evaluating fixed income investments, investors should consider factors such as credit quality, duration, yield, and liquidity to assess risk and return potential accurately.

Building a Better Portfolio

To construct a well-balanced portfolio using fixed income, investors should allocate assets based on their risk tolerance, investment objectives, and time horizon. A diversified mix of fixed income securities, including government, corporate, and municipal bonds, can help mitigate risk while providing income and stability to the overall portfolio.

Final thoughts

Fixed income investments play a crucial role in wealth-building strategies, offering a reliable source of income and capital preservation. You have to understand the various types of fixed income products, analyze associated risks and benefits, and implement sound investment strategies to effectively harness the power of fixed income to achieve your financial goals. Assets like bonds, certificates of deposit (CDs), and money-market funds serve to diversify your portfolio, shielding your capital during market fluctuations.

References

https://www.investopedia.com/terms/f/fixedincome.asp

https://fortune.com/recommends/investing/what-is-fixed-income-investing/